Consumers use both manufacturer and dealer websites in the new car buying journey but for very different reasons.

In today’s digital landscape, car buyers rely heavily on online resources to inform their purchase decisions. Consumers tend to use manufacturer websites during the early stages of research to explore vehicles, compare models, and learn about specifications. Once they’ve narrowed their options, they turn to dealer websites to check inventory, compare prices, and seek out deals. In this report we examine this dual-phase behaviour and make a compelling case for why both manufacturer and dealer websites serve distinct, but complementary, roles in the new car buying process.

Manufacturer Websites:

A Research Hub for Vehicles and Specifications!

Manufacturer websites serve as the primary resource for buyers when they are in the early research phase according to Car Dealer Magazine. This is when they are exploring various vehicle options, comparing different brands, playing with slick vehicle configurators and assessing technical specifications. These sites are designed to offer:

Detailed Specifications: Manufacturer websites provide comprehensive information on vehicle models, including performance specs, safety features, and customisation options. Buyers looking to learn about new technologies, engine choices, and interior features rely on these official sources. They learn about the brand values and fall in love, or not, with the brand and the specific vehicle of interest. It is the OEM’s responsibility, with their more focussed approach and significantly larger budget to make this happen and this is invariably the starting point of any research.

Brand Exploration: Consumers tend to visit manufacturer websites to understand the brand’s full line up, including the latest releases and concept vehicles. This allows them to evaluate what each brand offers in terms of reliability, design, and innovation. They can then decide if this aligns with their requirements.

Early-Stage Engagement: While these websites are pivotal for information gathering, they are typically used earlier in the process. Research shows that most car buyers start their search on manufacturer sites, signalling that while these sites are trusted for official information, buyers move on once they’ve chosen a brand and a model plus a few options.

Franchised Car Dealer Websites:

Where Buying Decisions Are Finalised!

Once buyers have narrowed down their options based on their research on manufacturer sites, media reviews and forums shift to dealer websites to finalise their decisions. This transition is marked by a shift in priorities, as buyers now focus on:

Vehicle Availability: Dealer websites are crucial for checking which specific models are in stock locally. Consumers would ideally want to buy locally and use dealer sites to find out whether their chosen vehicle is available nearby, and browse multiple dealer sites to ensure they are not missing out on a better option.

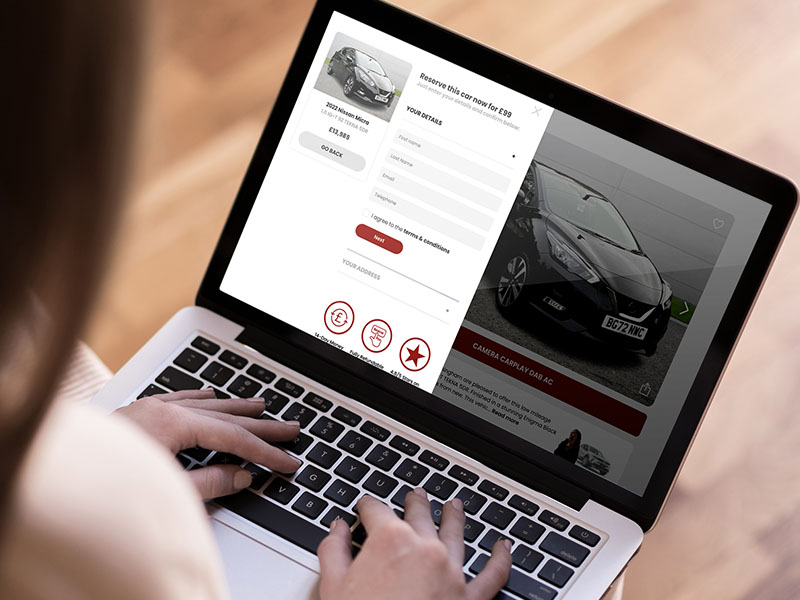

Pricing and Offers: Dealer websites are a key resource for comparing prices, special promotions and offers as well as financing options. Buyers look for transparency in pricing, often comparing various dealerships to secure the best deal. Vehicle Description Pages (VDPs) are a particularly valued part of the dealer site experience, with 42% of buyers reporting these pages as the most helpful resource during the later stages of the car buying process according to Digital Dealer Magazine.

Middle-to-Late-Stage Engagement: Dealer websites become more significant as buyers approach the point of purchase. They are used to check real-time pricing, inventory availability, and special offers—factors that are critical for making a final decision. This is evidenced by the fact that websites we build have a lower percentage of visitors to the new car categories than used cars and is further underlined by the fact that most visitors to new car pages on a dealer site are on offer pages not research pages as is seen in the below chart.

This chart below shows the most popular categories that consumers visit on typical car dealer website.

All visitors to over 30 different CaboodleCode Car Websites - Key Categories

| % of Total Visits | |

| Home Page/General | 9% |

| Used Vehicles | 68% |

| New Vehicles | 2% |

| Special Offers New | 9% |

| Aftersales | 11% |

| Motability | 1% |

In Summary

UK car buyers engage with manufacturer websites first when it comes to making a shortlist of vehicles to consider. They use OEM sites to research and compare vehicle models, brands, and technical specifications at the beginning of their journey. These websites serve as the official source of detailed information about a vehicle’s features and the latest brand offerings. However, once consumers have made a shortlist they visit media sites for reviews and test drives before making their choice. They shift to dealer websites, where they focus on practical considerations such as inventory, prices, and promotions. Dealer websites play a critical role in helping buyers finalise their decision by providing real-time information about available stock and deals in their area.

This two-step approach underscores the need for both manufacturer and dealer websites to be optimised for their distinct roles in the car buying process. Manufacturer sites must offer rich, informative content that engages buyers in the initial stages, while dealer websites need to provide up-to-date, transparent details on inventory and pricing to convert research into action.

The websites referenced for this article are as follows:

References: Automotive Digital Retail Insight Report (2023) – This report discusses how car buyers engage with different online platforms, specifically focusing on manufacturer and dealer websites, and their distinct roles in the buying journey

References: Car Dealer Magazine – This publication provided insight into buyer behaviour during the mid-to-late stages of the car buying process, including statistics on how often buyers visit dealer websites to compare prices and check availability.

References: CaboodleCode – data obtained from recording the traffic visiting 30 UK franchised car dealer websites and identifying the type of visit into categories.

Article written by Karl Rahmani Managing Director The Whole Caboodle

Please fill in your details below and let us know when you would like a demonstration of Online Car Events.

Got a question, a brief or a challenge you want to set, feel free to tell us.